For Enquiry !

Exclusive Benefits

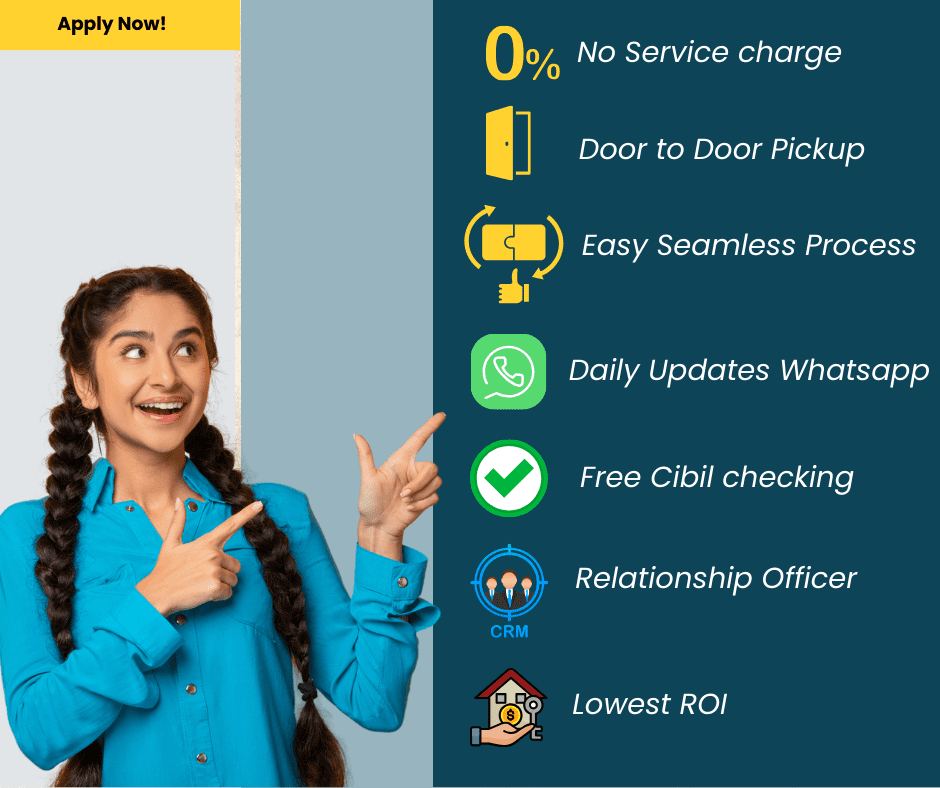

No Commision

No Service Charge

Daily Updates On

API Support

Free Document Collection

Team Support

Free Cibil Checking

Free Cibil Report

Why Choose Us? (Key Benefits)

We do not take any type of service charges or commission for your entire Loan Process.

Our Loan Team provides you door to door documents pickup service.

Total Loan guidance and Support is given to you for the entire loan process which makes the process Simple and Easy.

Our System is Totally Integrated with Whatsapp API Technology which Helps you to get the Regular Loan Process Updates on Daily Basis

We provide Free Cibil checking service to all our Customers before login which makes it Easier for Decision Making.

We Provide Dedicated Relationship Officer who guide, support and helps you in the entire Loan Process.

As we are associated with Top 40 Banks are NBFC, So we provide the best choice for the Loan Process according to your Profile.

Home Loan Category

CAT A CASES(8.35%)

CAT B CASES(9.55%)

CAT C CASES(10.80%)

Home Loan Category

Our USP

Working Product

Home Loan eligibility depends upon various factors which are as follows:

- Income – Your income determines the amount of home loan you are eligible for. Banks generally keep the EMI to income ratio at 0.45% to 0.60% of your monthly income.

- Tenure – The longer tenure you opt for, the more is your home loan eligibility and the lesser is your EMI. Maximum tenure is 20 years (30 years in some banks or NBFC’s).

- Age – Your age will determine your home loan tenure and hence your eligibility. Maximum age to be considered for salaried is 60 years and for self employed is 75 yrs.

- Interest Rate offered – Banks offer Fixed and Floating Rates of Interest. Lower the interest rate more is the home loan eligibity and higher the interest rate less is the home loan eligibity.

- CIBIL Score – Your credit report tells the bank about your repayment capacity and hence determines if you’re eligible for a loan.(credit score must be above 650)

Loan against property eligibility depends upon various factors which are as follows:

- Income – Your income determines the amount of LAP you are eligible for. Banks generally keep the EMI to income ratio at 0.45% to 0.60% of your monthly income.

- Tenure – The longer tenure you opt for, the more is your LAP eligibility and the lesser is your EMI. Maximum tenure is 15 years.

- Age – Your age will determine your LAP tenure and hence your eligibility. Maximum age to be considered for salaried is 60 years and for self employed is 75 yrs.

- Interest Rate offered – Banks offer Fixed and Floating Rates of Interest. Lower the interest rate more is the LAP eligibity and higher the interest rate less is the LAP eligibity.

- Valuation – LAP is totally depended on the valuation of the property. Maximum funding offered is 70% to 75% of the total valuation of the property.

- CIBIL Score – Your credit report tells the bank about your repayment capacity and hence determines if you’re eligible for a loan.(credit score must be above 650).

For more info

Balance transfer can be done of any ongoing loan such as Home Loan, Loan Against Property, Personal Loan And Business Loan.

- Income –Your income determines the amount of loan you are eligible for. Banks generally keep the EMI to income ratio at 0.45% to 0.60% of your monthly income. So outstanding amount of ongoing loan must not be more than your current loan eligibility.

- Tenure –The longer tenure you opt for, the more is your loan eligibility and the lesser is your EMI. Maximum tenure is 20 years.

- Age – Your age will determine your home loan tenure and hence your eligibility. Maximum age to be considered for salaried is 60 years and for self employed is 75 yrs.

- Interest Rate offered – Banks offer Fixed and Floating Rates of Interest. Lower the interest rate more is the loan eligibity and higher the interest rate less is the loan eligibity.

- CIBIL Score – Your credit report tells the bank about your repayment capacity and hence determines if you’re eligible for a loan. (Credit score must be above 650).There must not be any type of default in ongoing loans.

Loan Process

Cibil checking is done according to the KYC of customers and if cibil is OK case is moved to Lead Section.

KYC, Income document and Bank statement are Collected and file is prepare for Login and send to the Bank.

Login queries are cleared and if there is no query case is moved to Login Section.

Residence and Employment verification is done and if reports are clear the case is moved to sanction Section.

Property Papers are collected and send to Bank for Legal and Technical Verification.

Legal verification of the property papers and technical verification of the property is done and if both are Ok then case is moved to next Section.

Agreement ,Registration and Loan Docket signing is done and submitted to Bank and if all documents are clear then disbursement is done.

Testimonials

More Reviews Click On Below

Statistics

Our Branches

Palghar Branch

Flat no. 04, 2nd Floor,Rajeshwari Shopping Centre, Above Bholanath Sweet Mart, Mahim Rd, near Viva hotel, Palghar (W), 401404

Umbergaon Branch

Shop No.F-25, 1st Floor B-Building, Siddhivinayak Homes, Adarsh Nagar Road, Adarsh Nagar, Solsumba ,Umbergaon(E),396165.

Vasai Branch

Flat no 103, first floor,Sukhmani Apartment, Behind Punjab Bar And Restaurant, Navghar, Opp ST bus Depo, Vasai (W) -401202.